eCredable LiftLocker is designed to guide the first-time homebuyer through the complex process of preparing for a mortgage. Here's some information about various programs that can help you with your down payment as well as picking the right type of loan.

First-Time Homebuyer Loans, Programs, and Grants

BY ROBIN LAYTON

Updated February 15, 2022

fizkes / Shutterstock

fizkes / Shutterstock

Buying a new home for the first time can seem like you are preparing to climb Mount Everest. The National Association of Realtors (NAR) reports that the median home price was $358,000 at the end of 2021, and that first-time buyers made up 34% of all homebuyers, an increase from 2020’s 31%. The median down payment on a home is 12%, according to the NAR, and 6% for first-time buyers.

When you’re signing up for such a large amount of debt, finding the right first-time home buyer loan is crucial. That’s why we’ve created this guide to walk you through the first-time homeowner loans you should know about.

These loans and programs are intended to help you purchase your first home and navigate the first-time homeowner process through education. If you are unsure about whether you are ready to purchase a home, there are some considerations to think about before choosing between renting vs. buying. Keep in mind that many of these programs are open to returning homebuyers as well, but are especially useful to those who have never gone through the process of getting a mortgage.

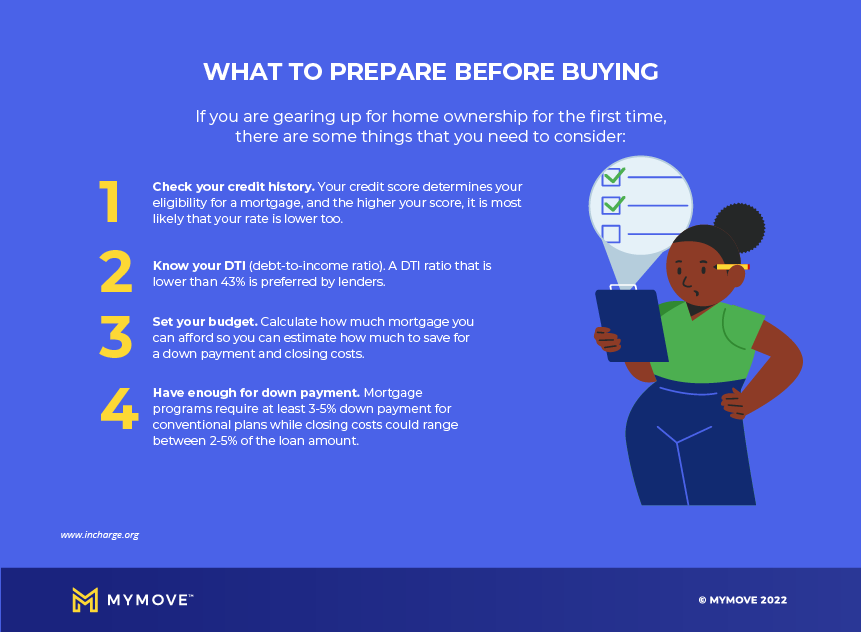

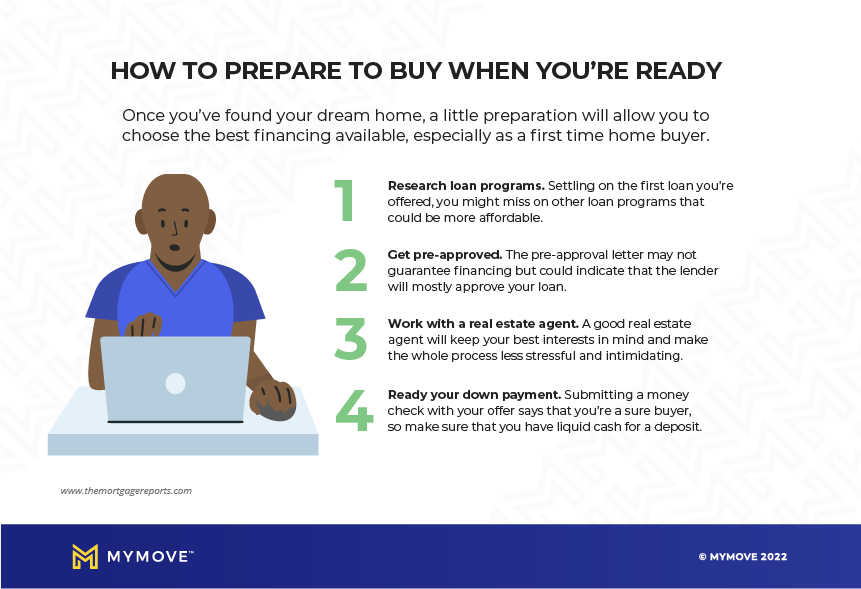

As you look through these options, check out our list of what to prepare before you start shopping for a new home:

FHA loan

Who’s eligible: Designed for low-credit consumers

Good fit for: First-time homebuyers with a small down payment

Qualifying credit scores: 580 or higher

FHA loans are the original first-time homebuyer’s loan, dating back to 1934. They are designed for those with low credit and require you to put as little as 3.5% down. Those with credit scores of 580 or higher are eligible, although if your credit score is as low as 500, you may be approved with a 10% down payment.

The main downside of an FHA loan is that you have to pay an annual mortgage insurance premium or MIP. This is an amount that goes into a protected account to make mortgage payments in case you default on your loan. The MIP is paid for anywhere from 11 years to the full term of the loan.

VA loan

Who’s eligible: U.S. veterans, current service members, and spouses

Good fit for: First-time homebuyers

Qualifying credit scores: 580 to 620

Provided by private lenders and partially guaranteed by the U.S. Department of Veterans Affairs, VA loans are intended to help military members and their families purchase homes. Service members who qualify can benefit from zero down payment options, lower fees, and better rates. This makes it a great first-time homebuyer loan since so little equity is required to get started with home ownership.

USDA loan

Who’s eligible: Adjusted household income is equal to or less than 115% of the area median income

Good fit for: Families that fall in these salary bands, 1-4 member household: $91,900 or 5-8 member household: $121,300; and a willingness to live in an area classified as rural.

Qualifying credit scores: There is no minimum credit requirement for the USDA loan. However, applicants with a credit score of 640 or higher are eligible for the USDA’s automated underwriting system. Applicants below the 640 mark may still be eligible, but they are subject to manual underwriting, which can mean more stringent guidelines.

The purpose of the USDA loan is to assist first-time homebuyers in purchasing property in designated rural areas. The idea behind the program is that the homebuyer will rehabilitate and improve the property and the surrounding area will benefit.

To be approved for a USDA loan, a homebuyer must fall within the program’s income eligibility and agree to occupy the home as their primary residence. They must also agree only to use the funds made available for a specific set of purposes pertaining to improving the property.

Good Neighbor Next Door

Who is eligible: Law enforcement, teachers, firefighters, and EMTs

Good fit for: First-time homebuyers who don’t mind living in an area marked for revitalization. The home may need some renovations.

Qualifying credit score: 580 or above

The Good Neighbor Next Door program makes it easier for first-time homebuyers in public service to purchase a property. The program reduces the list price on the property by 50% — as long as the recipient agrees to live there for at least three years.

There are some qualifications that must be met for this program. For example, only law enforcement, teachers, and firefighters/EMTs are eligible and in general, recipients must purchase a home in the jurisdiction in which they work.

Fannie Mae HomeReady loan

Who is eligible? Low-income first-time or repeat buyers

Good fit for: Someone with limited cash as a down payment

Qualifying credit score: 620

Fannie Mae HomeReady is one of two very similar first-time homeowner loans by Fannie Mae and Freddie Mac. The minimum down payment required is 3% lower than an FHA loan, and there are no geographic restrictions on the mortgage amount. To qualify, your income must be no more than 80% of the area’s median income. Borrowers can also choose to cancel their mortgage insurance once they reach at least 20% equity, leading to major long-term savings.

One requirement for first-time homebuyer loan recipients under HomeReady is that at least one person on the mortgage must complete the Framework online education program, which teaches new homebuyers how to calculate what they can afford, shop for the best loan, and navigate closing.

Freddie Mac Home Possible loan

Who is eligible: Very low- to low-income borrowers

Good fit for: First-time homebuyers, retirees, or move-up borrowers

Qualifying credit score: 660

Home Possible is another first-time homebuyer loan by Freddie Mac that is very similar to Fannie Mae’s HomeReady. The minimum down payment is also 3%; however, the income limit is less strict. Borrowers need to make less than the area median income, with the limit waived in some low-income areas. Home Possible has some additional interesting features, such as adding co-borrowers to the loan who do not need to occupy the home.

Energy Efficient Mortgage

Who is eligible: Anyone who wants to reduce their mortgage payment by investing in energy efficiency

Good fit for: Buyers, sellers, refinancers, remodelers

Qualifying credit score: 580

The Energy Efficient Mortgage is an interesting first-time homebuyer loan program run by the U.S. Department of Housing and Urban Development. It allows you to finance energy-saving improvements as part of the mortgage, leading to lower monthly utility bills and overall savings.

Something that you should always do as a first-time homebuyer is to think about what will happen when you want to sell your home. The Energy Efficient Mortgage allows you to increase your home’s resale value, so you get a better return on your investment, while simultaneously saving future owners long-term money by reducing the cost of ownership.

Native American Direct Loan

Who is eligible: Native American veterans purchasing a home on Federal Trust land

Good fit for: Native American veteran or a non–Native American veteran married to a Native American, meeting certain requirements.

Qualifying credit score: A “good” score, 670 or above

The Native American Direct Loan is one of the more specific loans on this list, but it’s one worth mentioning. Native American veterans can get 30-year fixed-rate mortgages with a 3.75% interest rate through this program. The caveat is that you must use the loan to purchase, build, or renovate a home on a federally recognized trust. There are frequently no down payments required and low closing costs. While no specific cutoffs are mentioned, beneficiaries must also show a good credit score and proof of ability to pay the mortgage.

FHA 203k loan

Who is eligible: Most homebuyers

Good fit for: Anyone interested in buying and immediately renovating a home

Qualifying credit score: 500

Renovating a home might sound daunting for first-time homebuyers, but the FHA 203k loan makes it possible. The program permits homebuyers and homeowners to finance up to $35,000 into their mortgage to repair, improve, or upgrade their homes. Borrowers can get financing for the purchase price of the home and the cost of future renovations, all in the same mortgage. There must be at least $5,000 in work done, and the renovated property must still fall within the FHA Mortgage Limits.

The Federal Housing Administration provides a list of activities that are deemed acceptable under the FHA 203k loan. They include structural alterations, health and safety improvements, adding accessible entrances, and even landscaping.

DPA Advantage

Who is eligible: First-time homebuyers who are educators, law enforcement, and medical and military personnel

Good fit for: Any first-time homebuyer, including homebuyers that haven’t owned a house in at least three years, are eligible.

Qualifying credit score: 620

DPA Advantage, overseen by American Financial Resources, is a grant for public service members that can help borrowers navigate a first-time homeowner loan. The grant is equal to 2% of the purchase price, plus up to 6% of closing costs. There are no restrictions on how long the buyer must occupy the home for.

Unlike Good Neighbor Next Door, DPA Advantage has a much more lenient view on who can benefit. Beneficiaries can be “current, retired, volunteer, or non-paid” members of a shortlist of professions, including educators, medical personnel, military members, and civil servants.

HUD Dollar Homes initiative

Who is eligible: Low- to moderate-income families

Good fit for: Low-income families who wouldn’t be able to buy a home otherwise

Qualifying credit score: 580

The idea of buying a home for a dollar sounds attractive, but unfortunately, it’s not quite that simple. The HUD Dollar Homes initiative is a program through which vacant houses with a list price of $25,000 or less that don’t sell after six months can be purchased for $1. However, individuals can’t just go out and buy these houses. They must be purchased by the local government.

The good news: These homes go to help low-income families that otherwise can’t buy a home, and would otherwise be first-time homebuyers.

HUD state-specific grants

Who is eligible: Most homebuyers

Good fit for: Varies

Qualifying credit score: 580

There may be additional first-time homebuyer loans available to you depending on your state. The U.S. Department of Housing and Urban Development maintains a list of these programs. Simply click the link for your home state, where you might find grants, subsidies, incentives, and more.

Nonprofit first-time homebuyer programs

Outside of federal homeownership programs, there are a number of nonprofits that can provide education, counseling, grants, and other types of funding to help you purchase your first home.

Habitat for Humanity

Who is eligible: Anyone “facing barriers to opportunity due to inadequate living conditions,” according to Habitat’s site.

Good fit for: Potential homebuyers who need better housing, can pay an affordable mortgage, and are willing to work with Habitat to make that happen.

Qualifying credit score: No minimum credit score, but they do check your history for any major issues.

Habitat’s homebuyers invest hours of their own labor, called sweat equity, to help build their new home. They work with volunteers and other Habitat homeowners, in addition to paying an affordable mortgage.

NeighborWorks America

Who is eligible: Anyone

Good fit for: First-time homebuyers

Qualifying credit score: N/A

NeighborWorks America is a public nonprofit corporation created by Congress to help homeowners by providing counseling and legal and financial assistance.

995 Hope

Who is eligible: Anyone

Good fit for: Anyone needing assistance with the home-buying or homeownership experience

Qualifying credit score: N/A

995 Hope can guide first-time buyers through the process. They can help guide you with each step from the home search, understanding the realtor’s role to how to access down payment assistance. Callers can expect to receive free, confidential, and comprehensive financial and foreclosure prevention education.

Money Management International

Who is eligible: Anyone

Good fit for: Anyone who needs guidance in home buying

Qualifying credit score: N/A

Money Management International offers two homebuyer counseling options, one-on-one homebuyer counseling or self-guided homebuyer education courses. Some courses are fee-based, but some are free if you are required to take them for other home-buying assistance programs.

Banks and mortgage lenders that offer first-time homebuyer incentives

When you approach a bank about a mortgage loan, do your research because most larger banks, and some smaller locally-owned banks, often offer some sort of first-time homebuyer incentives or programs.

Bank of America

Who is eligible: Modest-income and first-time homebuyers

Good fit for: Most first-time homebuyers

Qualifying credit score: 620

Bank of America offers America’s Home Grant and Down Payment Grant programs, as well as homebuyer education programs.

PNC Bank’s Community Mortgage

Who is eligible: Anyone

Good fit for: Anyone

Qualifying credit score: 620

PNC’s Community Mortgage program offers flexible, low down payments, lower monthly payments, and relaxed loan terms. The bank also offers a first-time homebuyer’s guide.

Wells Fargo

Who is eligible: First-time homebuyers

Good fit for: All first-time homebuyers

Qualifying credit score: 620

With the Dream. Plan. Home mortgage, first-time homebuyers may be eligible for a conventional fixed-rate mortgage with a down payment as low as 3%. These home loans can also be layered with monetary gifts and other down payment assistance programs.

Grants for first-time homebuyers

It can take some digging, but finding a grant to help with your down payment or closing costs can save you massive amounts of upfront cash when buying your first home. Remember, grants, unlike loans, do not need to be repaid.

FHA Down Payment Grants

Who is eligible: Any homebuyer

Good fit for: First-time buyers

Qualifying credit score: 580

There are many different types of programs available to homebuyers through the FHA. For first-time homebuyers, the federal agency offers a state-by-state listing of local government programs providing grants and loans.

National Homebuyers Fund

Who is eligible: Any homebuyer

Good fit for: First-time homebuyers

Qualifying credit score: 640

The Down Payment Assistance (DPA) grant is available up to 5% of the mortgage loan amount and can be used towards down payment and/or closing costs.

Chase Bank Eligible Housing Assistance Programs

Who is eligible: Most homebuyers

Good fit for: Varies, some programs are income and credit-rating restricted

Qualifying credit score: Varies by state

Chase Bank’s Eligible Housing Assistance Programs vary by state. Check out this listing to see what is available where you live.

Frequently Asked Questions

What is the best first-time homebuyer loan?

The best loans for first-time homebuyers depend on your credit score, income, profession, and where you live. FHA loans are a great option for those who are struggling to come up with a down payment.

How do you qualify for a loan as a first-time homebuyer?

If you’re worried about qualifying for a loan as a first-time homebuyer, look into loans and programs specifically for first-time homebuyers with low credit. These include FHA, Freddie Mac Home Possible, and Fannie Mae HomeReady.

How much of a down payment do I need for my first home?

These days, you might not need any more than 3% down on your first home. However, you might have to purchase mortgage insurance, at least until your equity in the home reaches 20%.

Are you ready?

Some preparation before you pick which financing to try for will save you some serious headaches in the home-buying process:

Robin Layton is an editor with MyMove and Allconnect. She works closely with the content team writers to ensure consumers get a fair and balanced reporting of the issues concerning movers, the state of broadband services, and more. Robin also writes breaking news from the internet world and how-to guides for navigating the digital divide.